Industry Overview

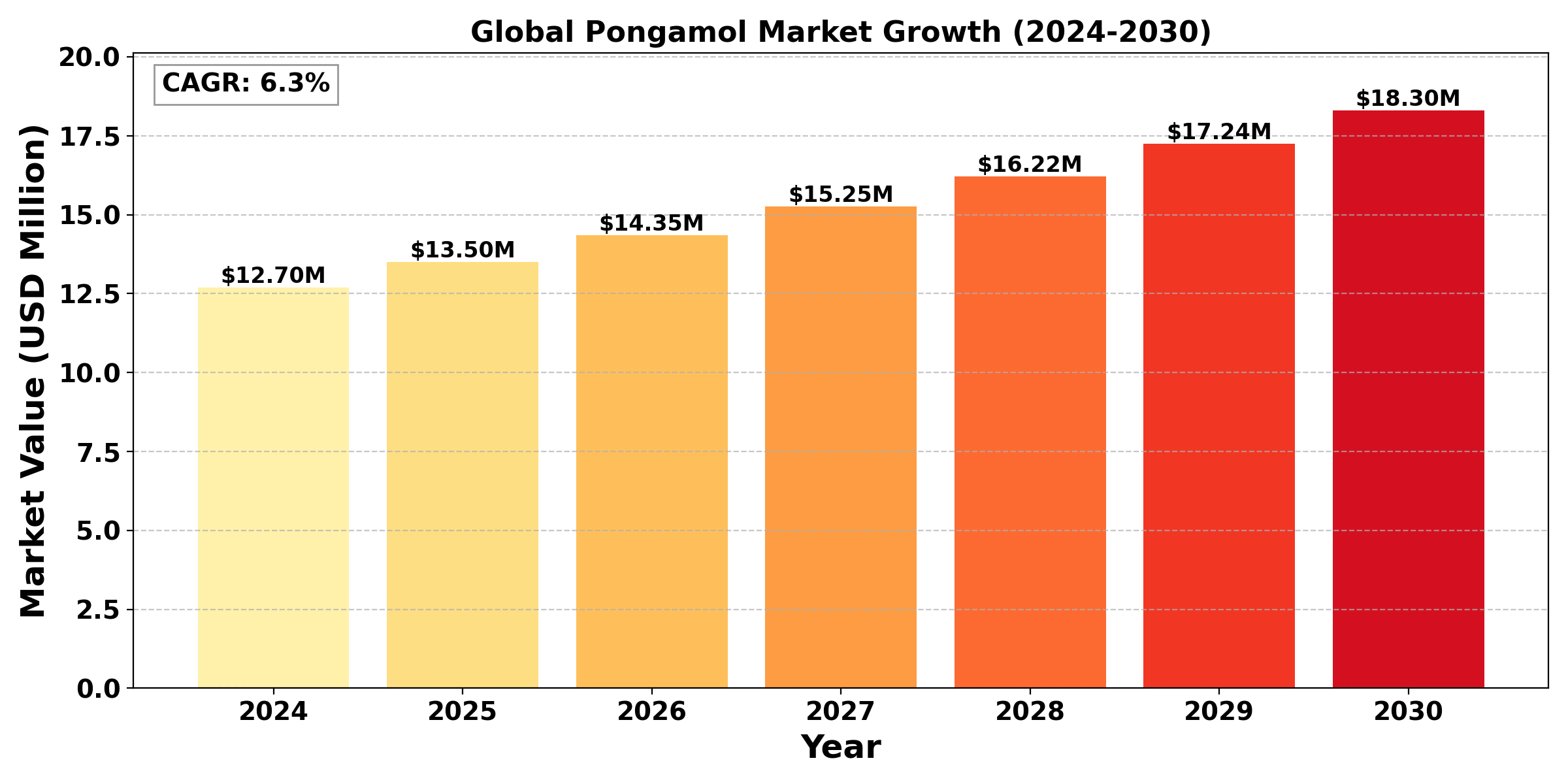

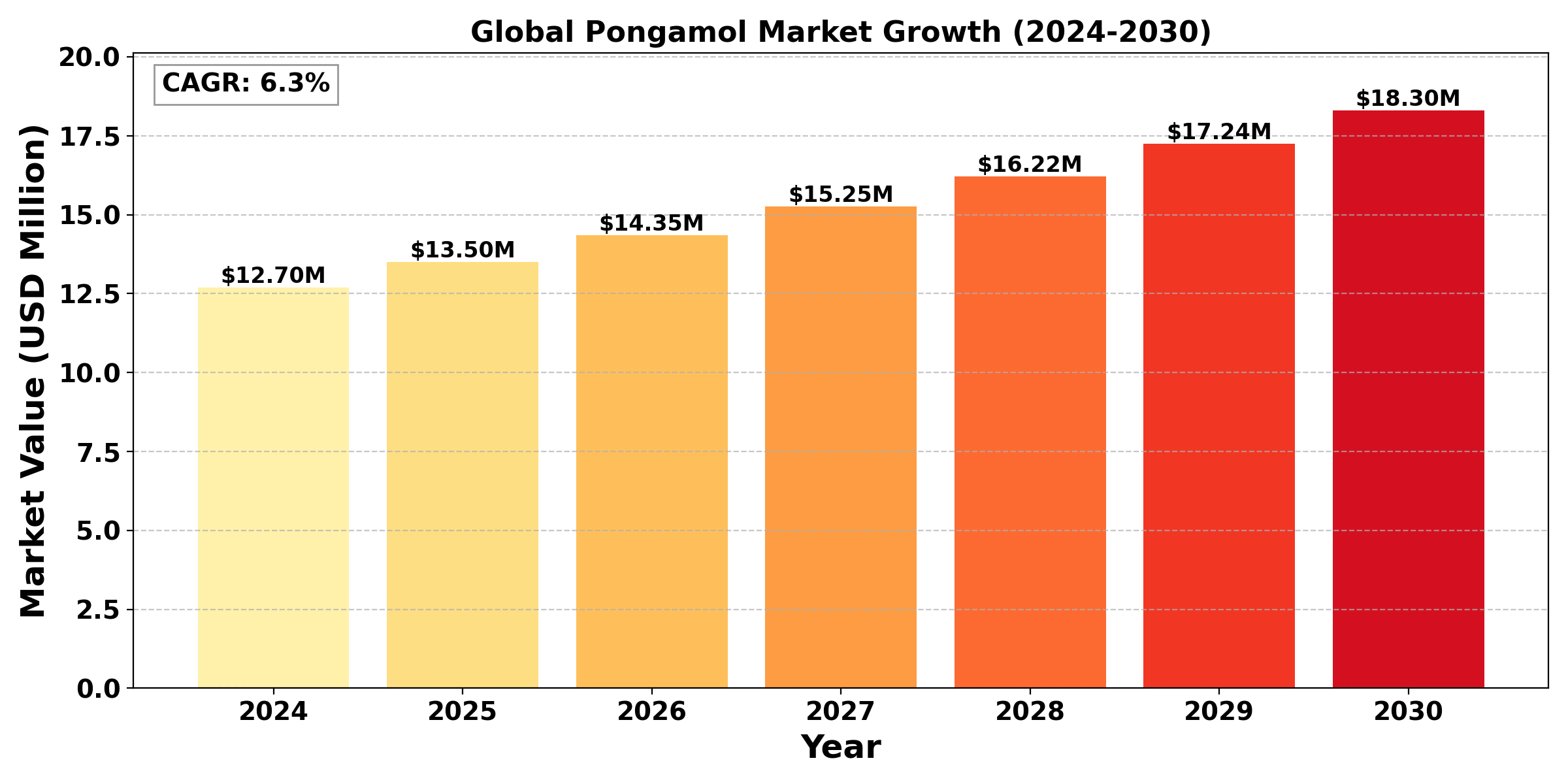

The "Global Pongamol Market" size was valued at US$ 12.7 Million in 2024 and is projected to reach US$ 18.3 Million by 2030, at a CAGR of 6.3% during the forecast period 2024-2030.

Pongamol is a flavonoid compound extracted from the seeds of Pongamia pinnata (Indian beech). It has the molecular formula C18H14O4 and is known for its potential therapeutic properties.Pongamol, a substance made from the seeds of the Pongamia pinnata tree, is produced and used in the pongamol business, which is a subset of the larger bio-based chemicals industry. Pongamol is becoming more well-known for its potential as a sustainable substitute for chemicals generated from petroleum, particularly in the manufacturing of lubricants, biodiesel, and other industrial uses. Interest in pongamol and its derivatives is being fueled by the desire to lessen reliance on fossil fuels and the increasing emphasis on renewable resources.

Pongamol is seen as a viable feedstock for a number of industries, including agrochemicals, pharmaceuticals, cosmetics, and the automotive sector, due to its natural and biodegradable nature. It can be formulated into high-performance lubricants and additives because to its special qualities, which include good lubricity and thermal stability, meeting the growing demand for environmentally friendly products.

Geographically, the market is most prominent in regions with abundant pongamia trees, such as India and Southeast Asia, where local cultivation supports the supply chain. However, the pongamol market is still emerging, facing challenges such as limited awareness of its benefits and competition from established synthetic alternatives. Nonetheless, ongoing research and development efforts aim to enhance the extraction processes and expand its applications, positioning pongamol for growth in the evolving landscape of sustainable chemicals.

Segmental Analysis

≥99% purity holds the highest market: By Type

In the pongamol market, the segment of ≥99% purity holds the highest market share compared to the <99% purity segment. This high-purity pongamol is increasingly preferred in various applications, particularly in industries that require specific quality standards, such as pharmaceuticals, cosmetics, and high-performance lubricants. The demand for ≥99% purity pongamol is driven by its superior properties and consistent performance, making it suitable for formulations where quality and effectiveness are critical. For instance, in the cosmetic and personal care sectors, high-purity pongamol is valued for its natural origin and beneficial attributes, contributing to the growing trend toward clean and sustainable ingredients.

Moreover, stringent regulatory standards in many industries further propel the demand for high-purity products, as manufacturers seek to comply with safety and quality regulations. While the <99% purity segment may cater to certain applications, it is the ≥99% purity pongamol that is capturing the majority of market interest and investment, positioning itself as the preferred choice among consumers and manufacturers seeking reliable and high-quality bio-based solutions.

Cosmetic and Personal Care to hold the highest Market share

In comparison to the pharmaceutical and organic synthesis divisions, the cosmetics and personal care category has the largest market share in the pongamol industry. The use of pongamol, which is prized for its advantageous qualities like anti-inflammatory and antioxidant activities, has increased dramatically in response to the growing demand for sustainable and natural components in cosmetic formulations.

Cosmetics makers are using pongamol in a variety of formulas, such as moisturizers, serums, and hair care products, as customers place a greater value on eco-friendly and clean products. Because of its natural origin, it fits in well with the growing trend of employing plant-based products, which appeals to consumers who care about the environment.

Furthermore, despite its importance, the pharmaceutical segment only accounts for a smaller portion of the market because of the strict regulations and particular formulations required for drug development. Similar to this, pongamol may find usage in organic synthesis, although this market is still in its infancy and does not yet rival the wide range of uses found in personal care and cosmetics.

Due to consumer product trends that emphasize natural ingredients and sustainable sourcing, the cosmetics and personal care sector is currently leading the pongamol industry.

Regional Overview

The global chlor-alkali membranes market is experiencing diverse growth across regions. North America leads, driven by stringent environmental regulations and advancements in membrane technology. Europe follows, with a strong emphasis on sustainability and energy-efficient processes. Europe market for Pongamol is estimated to increase from 1.02 million USD in 2024 to reach 1.36 million USD by 2030, at a CAGR of 4.91% during the forecast period of 2024through 2030.

The Asia-Pacific region, particularly China and India, showcases significant growth potential due to rapid industrialization and increasing demand for chlor-alkali products in various sectors. Asia-Pacific market for Pongamol is estimated to increase from 1.80 million USD in 2024 to reach 2.33 million USD by 2030, at a CAGR of 4.40% during the forecast period of 2024 through 2030.Meanwhile, Latin America and the Middle East are gradually adopting membrane technologies, supported by investments in infrastructure and manufacturing. Overall, regional dynamics are influenced by regulatory frameworks, industrial demands, and technological advancements, shaping the market landscape.

Competitive Analysis

- Spectrum Chemical

- Caming Pharmaceutical

- Shaanxi Dideu Group

- Hangzhou Hairui

- Other Key Players

Recent Development

➣ October 29, 2024, Camber Pharmaceuticals has been working towards expanding its product portfolio.Camber is excited to announce the introduction of 8 new generic products to our growing portfolio during the third quarter of this year. These launches mark a significant step forward in our ongoing mission to provide patients and healthcare providers with high-quality, cost-effective alternatives to brand-name medications.

Industry Dynamics

Industry Drivers

Growing consumer demand for natural and sustainable products

A significant driver of the pongamol market is the growing consumer demand for natural and sustainable products. As awareness of environmental issues and health concerns increases, consumers are increasingly turning to products that are derived from renewable resources rather than synthetic chemicals. This shift is particularly pronounced in industries such as cosmetics, personal care, and pharmaceuticals, where the trend towards clean beauty and natural formulations is gaining traction. Manufacturers are responding by incorporating bio-based ingredients like pongamol into their products, leveraging its natural properties and benefits. This trend not only caters to consumer preferences but also aligns with regulatory pressures and sustainability initiatives aimed at reducing the environmental footprint of products.

Consequently, the rising demand for natural and sustainable ingredients is fueling the growth of the pongamol market, driving innovation and expansion in its applications across various industries.

Industry Trend

Emphasis on environmentally friendly production techniques

The growing emphasis on environmentally friendly production techniques and sustainable sourcing is one noteworthy development in the pongamol market. The use of renewable raw materials with low ecological impact is becoming more and more important as both consumers and businesses grow more environmentally conscientious. In addition to being sustainable, pongamia pinnata trees—the source of pongamol—also favor biodiversity and soil health.

Developments in extraction and processing methods that increase pongamol production's output and efficiency while reducing waste and energy use further support this trend. Businesses are using green chemistry concepts more and more to make sure that their manufacturing procedures support the objectives of environmental sustainability. Furthermore, pongamol's incorporation into a variety of formulations—especially in cosmetics and personal care items—reflects a larger movement toward ingredient sourcing transparency and clean labeling. In an effort to attract health-conscious customers looking for products that are safe for their skin and the environment, brands are aggressively marketing the usage of natural ingredients. All things considered, the market for pongamol is being shaped by the trend toward sustainability and eco-friendly practices, which is also promoting innovation and broadening its uses in a variety of industries.

Industry Restraint

Limited awareness about product benefit

The lack of knowledge and comprehension of pongamol's advantages among producers and consumers is a major barrier to the market. Many potential consumers are still ignorant of pongamol's special qualities and uses, despite the growing interest in sustainable and natural components. Its adoption in a variety of industries may be hampered by this ignorance, especially in areas where conventional synthetic alternatives are well-established.

Furthermore, compared to easily accessible synthetic alternatives, the extraction of pongamol can be a complicated and resource-intensive procedure, resulting in higher production costs. Pongamol's market penetration may be constrained by this expensive hurdle, which may discourage startups or smaller producers from incorporating it into their product lines.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes

|

Details

|

|

Segments

|

By Type

By Application

- Pharmaceutical

- Cosmetics and Personal Care

- Organic Synthesis

|

|

Region Covered

|

- North America

- Europe

- Asia Pacific

- Middle East and Africa

- South Africa

|

|

Key Market Players

|

- Spectrum Chemical

- Caming Pharmaceutical

- Shaanxi Dideu Group

- Hangzhou Hairui

- Other Key Players

|

|

Report Coverage

|

- Industry Trends

- SWOT Analysis

- PESTEL Analysis

- Porter’s Five Forces Analysis

- Market Competition by Manufacturers

- Key Companies Profiled

- Marketing Channel, Distributors and Customers

- Market Dynamics

- Production and Supply Forecast

- Demand Forecast

- Research Findings and Conclusion

|

TABLE OF CONTENTS

1 Pongamol Market Overview

• 1.1 Product Definition

• 1.2 Pongamol by Type

• 1.2.1 Global Pongamol Market Value Growth Rate Analysis by Type: 2022 VS 2029

• 1.2.2 ≥99%

• 1.2.3 <99%

• 1.3 Pongamol by Application

• 1.3.1 Global Pongamol Market Value Growth Rate Analysis by Application: 2022 VS 2029

• 1.3.2 Pharmaceutical

• 1.3.3 Cosmetics and Personal Care

• 1.3.4 Organic Synthesis

• 1.4 Global Market Growth Prospects

• 1.4.1 Global Pongamol Production Value Estimates and Forecasts (2018-2029)

• 1.4.2 Global Pongamol Production Capacity Estimates and Forecasts (2018-2029)

• 1.4.3 Global Pongamol Production Estimates and Forecasts (2018-2029)

• 1.4.4 Global Pongamol Market Average Price Estimates and Forecasts (2018-2029)

• 1.5 Assumptions and Limitations

2 Market Competition by Manufacturers

• 2.1 Global Pongamol Production Market Share by Manufacturers (2018-2023)

• 2.2 Global Pongamol Production Value Market Share by Manufacturers (2018-2023)

• 2.3 Global Key Players of Pongamol, Industry Ranking, 2021 VS 2022

• 2.4 Global Pongamol Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

• 2.5 Global Pongamol Average Price by Manufacturers (2018-2023)

• 2.6 Global Key Manufacturers of Pongamol, Manufacturing Base Distribution and Headquarters

• 2.7 Global Key Manufacturers of Pongamol, Product Offered and Application

• 2.8 Global Key Manufacturers of Pongamol, Date of Enter into This Industry

• 2.9 Pongamol Market Competitive Situation and Trends

• 2.9.1 Pongamol Market Concentration Rate

• 2.9.2 Global 3 Largest Pongamol Players Market Share by Revenue

• 2.10 Mergers & Acquisitions, Expansion

3 Pongamol Production by Region

• 3.1 Global Pongamol Production Value Estimates and Forecasts by Region: 2018 VS 2023 VS 2029

• 3.2 Global Pongamol Production Value by Region (2018-2029)

• 3.2.1 Global Pongamol Production Value Market Share by Region (2018-2023)

• 3.2.2 Global Forecasted Production Value of Pongamol by Region (2024-2029)

• 3.3 Global Pongamol Production Estimates and Forecasts by Region: 2018 VS 2023 VS 2029

• 3.4 Global Pongamol Production by Region (2018-2029)

• 3.4.1 Global Pongamol Production Market Share by Region (2018-2023)

• 3.4.2 Global Forecasted Production of Pongamol by Region (2024-2029)

• 3.5 Global Pongamol Market Price Analysis by Region (2018-2023)

• 3.6 Global Pongamol Production and Value, Year-over-Year Growth

• 3.6.1 North America Pongamol Production Value Estimates and Forecasts (2018-2029)

• 3.6.2 China Pongamol Production Value Estimates and Forecasts (2018-2029)

4 Pongamol Consumption by Region

• 4.1 Global Pongamol Consumption Estimates and Forecasts by Region: 2018 VS 2023 VS 2029

• 4.2 Global Pongamol Consumption by Region (2018-2029)

• 4.2.1 Global Pongamol Consumption by Region (2018-2029)

• 4.2.2 Global Pongamol Forecasted Consumption by Region (2024-2029)

• 4.3 North America

• 4.3.1 North America Pongamol Consumption Growth Rate by Country: 2018 VS 2023 VS 2029

• 4.3.2 North America Pongamol Consumption by Country (2018-2029)

• 4.3.3 U.S.

• 4.3.4 Canada

• 4.4 Europe

• 4.4.1 Europe Pongamol Consumption Growth Rate by Country: 2018 VS 2023 VS 2029

• 4.4.2 Europe Pongamol Consumption by Country (2018-2029)

• 4.4.3 Germany

• 4.4.4 France

• 4.4.5 U.K.

• 4.4.6 Italy

• 4.4.7 Russia

• 4.5 Asia Pacific

• 4.5.1 Asia Pacific Pongamol Consumption Growth Rate by Country: 2018 VS 2023 VS 2029

• 4.5.2 Asia Pacific Pongamol Consumption by Region (2018-2029)

• 4.5.3 China

• 4.5.4 Japan

• 4.5.5 South Korea

• 4.5.6 Southeast Asia

• 4.5.7 India

• 4.5.8 Australia

• 4.6 Latin America

• 4.6.1 Latin America Pongamol Consumption Growth Rate by Country: 2018 VS 2023 VS 2029

• 4.6.2 Latin America Pongamol Consumption by Country (2018-2029)

• 4.6.3 Mexico

• 4.6.4 Brazil

• 4.7 Middle East & Africa

5 Segment by Type

• 5.1 Global Pongamol Production by Type (2018-2029)

• 5.1.1 Global Pongamol Production by Type (2018-2023)

• 5.1.2 Global Pongamol Production by Type (2024-2029)

• 5.1.3 Global Pongamol Production Market Share by Type (2018-2029)

• 5.2 Global Pongamol Production Value by Type (2018-2029)

• 5.2.1 Global Pongamol Production Value by Type (2018-2023)

• 5.2.2 Global Pongamol Production Value by Type (2024-2029)

• 5.2.3 Global Pongamol Production Value Market Share by Type (2018-2029)

• 5.3 Global Pongamol Price by Type (2018-2029)

6 Segment by Application

• 6.1 Global Pongamol Production by Application (2018-2029)

• 6.1.1 Global Pongamol Production by Application (2018-2023)

• 6.1.2 Global Pongamol Production by Application (2024-2029)

• 6.1.3 Global Pongamol Production Market Share by Application (2018-2029)

• 6.2 Global Pongamol Production Value by Application (2018-2029)

• 6.2.1 Global Pongamol Production Value by Application (2018-2023)

• 6.2.2 Global Pongamol Production Value by Application (2024-2029)

• 6.2.3 Global Pongamol Production Value Market Share by Application (2018-2029)

• 6.3 Global Pongamol Price by Application (2018-2029)

7 Key Companies Profiled

• 7.1 Spectrum Chemical

• 7.1.1 Spectrum Chemical Pongamol Company Information

• 7.1.2 Spectrum Chemical Pongamol Product Portfolio

• 7.1.3 Spectrum Chemical Pongamol Production, Value, Price and Gross Margin (2018-2023)

• 7.1.4 Spectrum Chemical Main Business and Markets Served

• 7.1.5 Spectrum Chemical Recent Developments/Updates

• 7.2 Caming Pharmaceutical

• 7.2.1 Caming Pharmaceutical Pongamol Company Information

• 7.2.2 Caming Pharmaceutical Pongamol Product Portfolio

• 7.2.3 Caming Pharmaceutical Pongamol Production, Value, Price and Gross Margin (2018-2023)

• 7.2.4 Caming Pharmaceutical Main Business and Markets Served

• 7.3 Shaanxi Dideu Group

• 7.3.1 Shaanxi Dideu Group Pongamol Company Information

• 7.3.2 Shaanxi Dideu Group Pongamol Product Portfolio

• 7.3.3 Shaanxi Dideu Group Pongamol Production, Value, Price and Gross Margin (2018-2023)

• 7.3.4 Shaanxi Dideu Group Main Business and Markets Served

• 7.4 Hangzhou Hairui

• 7.4.1 Hangzhou Hairui Pongamol Company Information

• 7.4.2 Hangzhou Hairui Pongamol Product Portfolio

• 7.4.3 Hangzhou Hairui Pongamol Production, Value, Price and Gross Margin (2018-2023)

• 7.4.4 Hangzhou Hairui Main Business and Markets Served

• 7.5 Tokyo Chemical Industry (TCI) (Reagent Grade)

• 7.5.1 Tokyo Chemical Industry (TCI) Pongamol Company Information

• 7.5.2 Tokyo Chemical Industry (TCI) Pongamol Product Portfolio

• 7.5.3 Tokyo Chemical Industry (TCI) Main Business and Markets Served

• 7.6 Toronto Research Chemicals (TRC) (LGC) (Reagent Grade)

• 7.6.1 Toronto Research Chemicals (TRC) (LGC) Pongamol Company Information

• 7.6.2 Toronto Research Chemicals (TRC) (LGC) Pongamol Product Portfolio

• 7.6.3 Toronto Research Chemicals (TRC) (LGC) Main Business and Markets Served

• 7.6.4 Toronto Research Chemicals (TRC) (LGC) Recent Developments/Updates

• 7.7 Biosynth (Reagent Grade)

• 7.7.1 Biosynth Pongamol Company Information

• 7.7.2 Biosynth Pongamol Product Portfolio

• 7.7.3 Biosynth Main Business and Markets Served

• 7.7.4 Biosynth Recent Developments/Updates

• 7.8 Key Organics (Reagent Grade)

• 7.8.1 Key Organics Pongamol Company Information

• 7.8.2 Key Organics Pongamol Product Portfolio

• 7.8.3 Key Organics Main Business and Markets Served

• 7.8.4 Key Organics Recent Developments/Updates

• 7.9 INDOFINE Chemical Company (Reagent Grade)

• 7.9.1 INDOFINE Chemical Company Pongamol Company Information

• 7.9.2 INDOFINE Chemical Company Pongamol Product Portfolio

• 7.9.3 INDOFINE Chemical Company Main Business and Markets Served

• 7.10 Amadis Chemical (Reagent Grade)

• 7.10.1 Amadis Chemical Pongamol Company Information

• 7.10.2 Amadis Chemical Pongamol Product Portfolio

• 7.10.3 Amadis Chemical Main Business and Markets Served

• 7.11 Wuhan ChemNorm Biotech (Reagent Grade)

• 7.11.1 Wuhan ChemNorm Biotech Pongamol Company Information

• 7.11.2 Wuhan ChemNorm Biotech Pongamol Product Portfolio

• 7.11.3 Wuhan ChemNorm Biotech Main Business and Markets Served

8 Industry Chain and Sales Channels Analysis

• 8.1 Pongamol Industry Chain Analysis

• 8.2 Pongamol Key Raw Materials

• 8.2.1 Key Raw Materials

• 8.2.2 Raw Materials Key Suppliers

• 8.3 Pongamol Production Mode & Process

• 8.4 Pongamol Sales and Marketing

• 8.4.1 Pongamol Sales Channels

• 8.4.2 Pongamol Distributors

• 8.5 Pongamol Customers

9 Pongamol Market Dynamics

• 9.1 Pongamol Industry Trends

• 9.2 Pongamol Market Drivers

• 9.3 Pongamol Market Challenges

• 9.4 Pongamol Market Restraints

10 Research Findings and Conclusion

11 Methodology and Data Source

• 11.1 Methodology/Research Approach

• 11.1.1 Research Programs/Design

• 11.1.2 Market Size Estimation

• 11.1.3 Market Breakdown and Data Triangulation

• 11.2 Data Source

• 11.2.1 Secondary Sources

• 11.2.2 Primary Source

LIST OF TABLES & FIGURES

• Table 1. Global Pongamol Market Value by Type, (US$ Million) & (2023 VS 2029)

• Table 2. Global Pongamol Market Value by Application, (US$ Million) & (2023 VS 2029)

• Table 3. Global Pongamol Production Capacity (MT) by Manufacturers in 2022

• Table 4. Global Pongamol Production by Manufacturers (2018-2023) & (MT)

• Table 5. Global Pongamol Production Market Share by Manufacturers (2018-2023)

• Table 6. Global Pongamol Production Value by Manufacturers (2018-2023) & (US$ Million)

• Table 7. Global Pongamol Production Value Share by Manufacturers (2018-2023)

• Table 8. Global Key Players of Pongamol, Industry Ranking, 2021 VS 2022

• Table 9. Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Production Value in Pongamol as of 2022)

• Table 10. Global Market Pongamol Average Price by Manufacturers (USD/Kg) & (2018-2023)

• Table 11. Global Key Manufacturers of Pongamol, Manufacturing Base Distribution and Headquarters

• Table 12. Global Key Manufacturers of Pongamol, Product Offered and Application

• Table 13. Global Key Manufacturers of Pongamol, Date of Enter into This Industry

• Table 14. Global Pongamol Manufacturers Market Concentration Ratio (CR5 and HHI)

• Table 15. Mergers & Acquisitions, Expansion Plans

• Table 16. Global Pongamol Production Value by Region: 2018 VS 2023 VS 2029 (US$ Million)

• Table 17. Global Pongamol Production Value (US$ Million) by Region (2018-2023)

• Table 18. Global Pongamol Production Value Market Share by Region (2018-2023)

• Table 19. Global Pongamol Production Value (US$ Million) Forecast by Region (2024-2029)

• Table 20. Global Pongamol Production Value Market Share Forecast by Region (2024-2029)

• Table 21. Global Pongamol Production Comparison by Region: 2018 VS 2023 VS 2029 (MT)

• Table 22. Global Pongamol Production (MT) by Region (2018-2023)

• Table 23. Global Pongamol Production Market Share by Region (2018-2023)

• Table 24. Global Pongamol Production (MT) Forecast by Region (2024-2029)

• Table 25. Global Pongamol Production Market Share Forecast by Region (2024-2029)

• Table 26. Global Pongamol Market Average Price (USD/Kg) by Region (2018-2023)

• Table 27. Global Pongamol Market Average Price (USD/Kg) by Region (2024-202*)

• Table 28. Global Pongamol Consumption Growth Rate by Region: 2018 VS 2023 VS 2029 (MT)

• Table 29. Global Pongamol Consumption by Region (2018-2023) & (MT)

• Table 30. Global Pongamol Consumption Market Share by Region (2018-2023)

• Table 31. Global Pongamol Forecasted Consumption by Region (2024-2029) & (MT)

• Table 32. Global Pongamol Forecasted Consumption Market Share by Region (2018-2023)

• Table 33. North America Pongamol Consumption Growth Rate by Country: 2018 VS 2023 VS 2029 (MT)

• Table 34. North America Pongamol Consumption by Country (2018-2023) & (MT)

• Table 35. North America Pongamol Consumption by Country (2024-2029) & (MT)

• Table 36. Europe Pongamol Consumption Growth Rate by Country: 2018 VS 2023 VS 2029 (MT)

• Table 37. Europe Pongamol Consumption by Country (2018-2023) & (MT)

• Table 38. Europe Pongamol Consumption by Country (2024-2029) & (MT)

• Table 39. Asia Pacific Pongamol Consumption Growth Rate by Country: 2018 VS 2023 VS 2029 (MT)

• Table 40. Asia Pacific Pongamol Consumption by Region (2018-2023) & (MT)

• Table 41. Asia Pacific Pongamol Consumption by Region (2024-2029) & (MT)

• Table 42. Latin America Pongamol Consumption Growth Rate by Country: 2018 VS 2023 VS 2029 (MT)

• Table 43. Latin America Pongamol Consumption by Country (2018-2023) & (MT)

• Table 44. Latin America Pongamol Consumption by Country (2024-2029) & (MT)

• Table 45. Global Pongamol Production (MT) by Type (2018-2023)

• Table 46. Global Pongamol Production (MT) by Type (2024-2029)

• Table 47. Global Pongamol Production Market Share by Type (2018-2023)

• Table 48. Global Pongamol Production Market Share by Type (2024-2029)

• Table 49. Global Pongamol Production Value (US$ Million) by Type (2018-2023)

• Table 50. Global Pongamol Production Value (US$ Million) by Type (2024-2029)

• Table 51. Global Pongamol Production Value Market Share by Type (2018-2023)

• Table 52. Global Pongamol Production Value Market Share by Type (2024-2029)

• Table 53. Global Pongamol Price (USD/Kg) by Type (2018-2023)

• Table 54. Global Pongamol Price (USD/Kg) by Type (2024-2029)

• Table 55. Global Pongamol Production (MT) by Application (2018-2023)

• Table 56. Global Pongamol Production (MT) by Application (2024-2029)

• Table 57. Global Pongamol Production Market Share by Application (2018-2023)

• Table 58. Global Pongamol Production Market Share by Application (2024-2029)

• Table 59. Global Pongamol Production Value (US$ Million) by Application (2018-2023)

• Table 60. Global Pongamol Production Value (US$ Million) by Application (2024-2029)

• Table 61. Global Pongamol Production Value Market Share by Application (2018-2023)

• Table 62. Global Pongamol Production Value Market Share by Application (2024-2029)

• Table 63. Global Pongamol Price (USD/Kg) by Application (2018-2023)

• Table 64. Global Pongamol Price (USD/Kg) by Application (2024-2029)

• Table 65. Spectrum Chemical Pongamol Company Information

• Table 66. Spectrum Chemical Pongamol Specification and Application

• Table 67. Spectrum Chemical Pongamol Production (MT), Value (US$ Million), Price (USD/Kg) and Gross Margin (2018-2023)

• Table 68. Spectrum Chemical Main Business and Markets Served

• Table 69. Spectrum Chemical Recent Developments/Updates

• Table 70. Caming Pharmaceutical Pongamol Company Information

• Table 71. Caming Pharmaceutical Pongamol Specification and Application

• Table 72. Caming Pharmaceutical Pongamol Production (MT), Value (US$ Million), Price (USD/Kg) and Gross Margin (2018-2023)

• Table 73. Caming Pharmaceutical Main Business and Markets Served

• Table 74. Shaanxi Dideu Group Pongamol Company Information

• Table 75. Shaanxi Dideu Group Pongamol Specification and Application

• Table 76. Shaanxi Dideu Group Pongamol Production (MT), Value (US$ Million), Price (USD/Kg) and Gross Margin (2018-2023)

• Table 77. Shaanxi Dideu Group Main Business and Markets Served

• Table 78. Hangzhou Hairui Pongamol Company Information

• Table 79. Hangzhou Hairui Pongamol Specification and Application

• Table 80. Hangzhou Hairui Pongamol Production (MT), Value (US$ Million), Price (USD/Kg) and Gross Margin (2018-2023)

• Table 81. Hangzhou Hairui Main Business and Markets Served

• Table 82. Tokyo Chemical Industry (TCI) Pongamol Company Information

• Table 83. Tokyo Chemical Industry (TCI) Pongamol Specification and Application

• Table 84. Tokyo Chemical Industry (TCI) Main Business and Markets Served

• Table 85. Toronto Research Chemicals (TRC) (LGC) Pongamol Company Information

• Table 86. Toronto Research Chemicals (TRC) (LGC) Pongamol Specification and Application

• Table 87. Toronto Research Chemicals (TRC) (LGC) Main Business and Markets Served

• Table 88. Toronto Research Chemicals (TRC) (LGC) Recent Developments/Updates

• Table 89. Biosynth Pongamol Company Information

• Table 90. Biosynth Pongamol Specification and Application

• Table 91. Biosynth Main Business and Markets Served

• Table 92. Biosynth Recent Developments/Updates

• Table 93. Key Organics Pongamol Company Information

• Table 94. Key Organics Pongamol Specification and Application

• Table 95. Key Organics Main Business and Markets Served

• Table 96. Key Organics Recent Developments/Updates

• Table 97. INDOFINE Chemical Company Pongamol Company Information

• Table 98. INDOFINE Chemical Company Pongamol Specification and Application

• Table 99. INDOFINE Chemical Company Main Business and Markets Served

• Table 100. Amadis Chemical Pongamol Company Information

• Table 101. Amadis Chemical Pongamol Specification and Application

• Table 102. Amadis Chemical Main Business and Markets Served

• Table 103. Wuhan ChemNorm Biotech Pongamol Company Information

• Table 104. Wuhan ChemNorm Biotech Pongamol Specification and Application

• Table 105. Wuhan ChemNorm Biotech Main Business and Markets Served

• Table 106. Key Raw Materials Lists

• Table 107. Raw Materials Key Suppliers Lists

• Table 108. Pongamol Distributors List

• Table 109. Pongamol Customers List

• Table 110. Pongamol Market Trends

• Table 111. Pongamol Market Drivers

• Table 112. Pongamol Market Challenges

• Table 113. Pongamol Market Restraints

• Table 114. Research Programs/Design for This Report

• Table 115. Key Data Information from Secondary Sources

• Table 116. Key Data Information from Primary Sources

• Table 117. Authors List of This Report

• Table 118. QYR Business Unit and Senior & Team Lead Analyst

• Figure 1. Product Picture of Pongamol

• Figure 2. Global Pongamol Market Value by Type, (US$ Million) & (2023 VS 2029)

• Figure 3. Global Pongamol Market Share by Type: 2022 VS 2029

• Figure 4. Global Pongamol Market Value by Application, (US$ Million) & (2023 VS 2029)

• Figure 5. Global Pongamol Market Share by Application: 2022 VS 2029

• Figure 6. Pharmacological Activities of Pongamol

• Figure 7. Pharmaceutical

• Figure 8. Cosmetics and Personal Care

• Figure 9. Organic Synthesis

• Figure 10. Global Pongamol Production Value (US$ Million), 2018 VS 2023 VS 2029

• Figure 11. Global Pongamol Production Value (US$ Million) & (2018-2029)

• Figure 12. Global Pongamol Production Capacity (MT) & (2018-2029)

• Figure 13. Global Pongamol Production (MT) & (2018-2029)

• Figure 14. Global Pongamol Average Price (USD/Kg) & (2018-2029)

• Figure 15. Pongamol Report Years Considered

• Figure 16. Pongamol Production Share by Manufacturers in 2022

• Figure 17. Pongamol Market Share by Company Type (Tier 1, Tier 2, and Tier 3): 2018 VS 2022

• Figure 18. The Global 3 Largest Players: Market Share by Pongamol Revenue in 2022

• Figure 19. Global Pongamol Production Value by Region: 2018 VS 2023 VS 2029 (US$ Million)

• Figure 20. Global Pongamol Production Value Market Share by Region: 2018-2029

• Figure 21. Global Pongamol Production Comparison by Region: 2018 VS 2023 VS 2029 (MT)

• Figure 22. Global Pongamol Production Market Share by Region: 2018-2029

• Figure 23. North America Pongamol Production Value (US$ Million) Growth Rate (2018-2029)

• Figure 24. China Pongamol Production Value (US$ Million) Growth Rate (2018-2029)

• Figure 25. Global Pongamol Consumption by Region: 2018 VS 2023 VS 2029 (MT)

• Figure 26. Global Pongamol Consumption Market Share by Region: 2018-2029

• Figure 27. North America Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 28. North America Pongamol Consumption Market Share by Country (2018-2029)

• Figure 29. U.S. Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 30. Canada Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 31. Europe Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 32. Europe Pongamol Consumption Market Share by Country (2018-2029)

• Figure 33. Germany Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 34. France Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 35. U.K. Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 36. Italy Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 37. Russia Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 38. Asia Pacific Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 39. Asia Pacific Pongamol Consumption Market Share by Region (2024-2029)

• Figure 40. China Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 41. Japan Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 42. South Korea Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 43. Southeast Asia Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 44. India Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 45. Australia Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 46. Latin America Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 47. Latin America Pongamol Consumption Market Share by Country (2018-2029)

• Figure 48. Mexico Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 49. Brazil Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 50. Middle East & Africa Pongamol Consumption and Growth Rate (2018-2029) & (MT)

• Figure 51. Global Production Market Share of Pongamol by Type (2018-2029)

• Figure 52. Global Production Value Market Share of Pongamol by Type (2018-2029)

• Figure 53. Global Pongamol Price (USD/Kg) by Type (2018-2029)

• Figure 54. Global Production Market Share of Pongamol by Application (2018-2029)

• Figure 55. Global Production Value Market Share of Pongamol by Application (2018-2029)

• Figure 56. Global Pongamol Price (USD/Kg) by Application (2018-2029)

• Figure 57. Pongamol Value Chain

• Figure 58. Natural Sources of Pongamol

• Figure 59. Pongamol Production Process and Anti-inflammatory Activity

• Figure 60. Channels of Distribution (Direct Vs Distribution)

• Figure 61. Distributors Profiles

• Figure 62. Bottom-up and Top-down Approaches for This Report

• Figure 63. Data Triangulatio