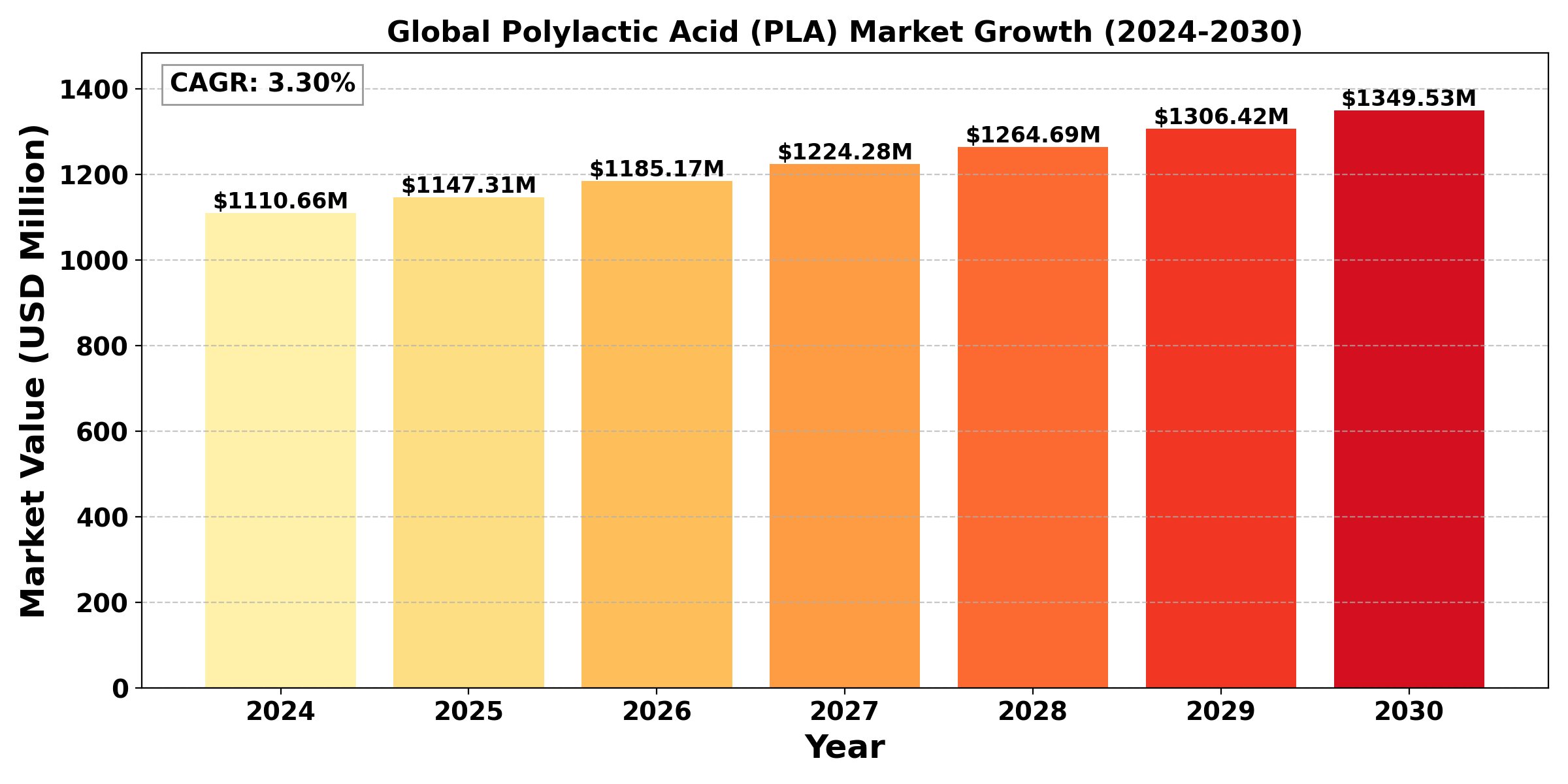

The "Global Polylactic Acid (PLA) Market" Size was estimated at USD 1110.66 million in 2024 and is projected to reach USD 1349.53 million by 2030, exhibiting a CAGR of 3.30% during the forecast period.

The growing need for sustainable and biodegradable materials across a range of industries is propelling the robust expansion of the global polylactic acid (PLA) market. PLA, a biopolymer made from renewable resources like sugarcane or maize starch, provides a good substitute for conventional plastics made from petroleum. Its qualities, including as its biodegradability, ease of processing, and adaptability, make it appropriate for a variety of uses, ranging from textiles and 3D printing to packaging and throwaway goods. The adoption of PLA has been further accelerated by growing consumer awareness of environmental issues and the need for sustainable manufacturing processes, especially in the food and beverage packaging sector, where PLA is being used more and more for containers, films, and cutlery.

Segmental Analysis

Injection molding grade PLA to hold the highest market share: By Type

Injection molding grade PLA has the largest market share in the global polylactic acid (PLA) industry, mostly because of its broad use and adaptability in producing a wide range of goods. This kind of PLA was created especially for injection molding procedures, which enable the efficient and precise creation of intricate shapes and designs. Injection molding grade PLA is the preferred material for a wide range of applications, such as packaging, consumer goods, automotive components, and disposable

The popularity of PLA for injection molding has been further supported by the growing need for environmentally friendly and biodegradable materials in consumer goods and packaging. Businesses are looking more and more for environmentally suitable substitutes for conventional plastics in order to satisfy customer demands and legal mandates to cut down on plastic waste. Furthermore, injection molding grade PLA's performance properties have been improved by advances in manufacturing technology, making it appropriate for increasingly demanding applications. With continued advancements and growing expenditures in bioplastics, the injection molding grade PLA sector is anticipated to hold its dominant market share as long as industries continue to prioritize sustainability and environmental responsibility.

High Purity PLA to hold the highest market share: By Purity

High purity PLA has the largest market share in the global polylactic acid (PLA) industry, mostly because of its exceptional performance qualities and appropriateness for specific applications. Low levels of impurities and a larger molecular weight are characteristics of high purity PLA, which result in improved mechanical qualities, thermal stability, and general performance. This makes it especially useful in situations where material purity and safety are crucial, like pharmaceutical packaging, medical gadgets, and luxury consumer goods.

Since high purity PLA satisfies strict regulatory requirements for medical applications, its adoption has been greatly accelerated by the growing need for biocompatible and biodegradable materials in the healthcare industry. Furthermore, because high purity PLA comes from renewable resources and has a smaller environmental impact than traditional plastics, sustainability-focused sectors are giving it more importance. Its market share is anticipated to increase as producers keep coming up with new ideas and improving the quality of high purity PLA, particularly as awareness of sustainability and material safety rises across a range of industries. On the other hand, low purity PLA is frequently used in less demanding applications, which leads to a comparatively lesser market share as companies choose higher grade materials to satisfy changing regulatory and consumer requirements.

Regional Analysis

The global polylactic acid (PLA) market is dominated by North America and Europe, driven by stringent regulations on plastic usage and a strong emphasis on sustainability. North America, particularly the United States, is witnessing robust growth due to advancements in bioplastics technology and increasing demand from the food packaging and medical sectors. Europe follows closely, with countries like Germany and France leading in PLA production and consumption, supported by eco-conscious consumers and policies promoting biodegradable materials.

In the Asia-Pacific region, rapid industrialization, particularly in China and Japan, is boosting PLA adoption, driven by a growing awareness of environmental issues and agricultural advancements. Emerging markets in Latin America and the Middle East are also showing potential, as regional industries increasingly seek sustainable alternatives to conventional plastics. Overall, the PLA market is expected to grow as sustainability initiatives gain momentum globally.

Competitive Analysis

The polylactic acid (PLA) market is characterized by intense competition among a mix of established players and emerging companies, each striving to capitalize on the growing demand for sustainable materials. Key industry players such as NatureWorks LLC, BASF SE, TotalEnergies Corbion, and Mitsubishi Chemical Corporation dominate the market, leveraging their extensive research and development capabilities to enhance PLA properties and expand application ranges. These companies focus on innovation, product differentiation, and establishing strategic partnerships to secure supply chains and improve production efficiency.

End User Analysis

The packaging, textile, consumer goods, and medical sectors are the most in-demand end-user industries served by the polylactic acid (PLA) industry. Due to customer desires for environmentally friendly substitutes for traditional plastics, PLA is being used more and more in the packaging sector for biodegradable containers, films, and utensils. By utilizing PLA's biodegradability and adaptability, the textile industry is also adopting it for environmentally friendly textiles used in apparel and non-woven materials. PLA is becoming more popular in the consumer goods industry for making durable and disposable products that appeal to consumers who care about the environment. Because of its safety and biocompatibility, high purity PLA is utilized in the medical industry, an end user that is expanding quickly. Applications include implanted devices, medication delivery systems, and sutures. As sustainability becomes a key focus across industries, the demand for PLA is expected to expand, with innovations in formulation and applications further driving its adoption in various end-user segments.

Industry Analysis

Industry Drivers

Increasing demand for sustainable and biodegradable materials

The increasing demand from consumers for sustainable and biodegradable materials is one of the main factors propelling the polylactic acid (PLA) sector. Customers are looking for alternatives to conventional plastics made from petroleum, which contribute to waste and pollution, as environmental concerns get more attention. Manufacturers in a number of industries, most notably packaging, textiles, and consumer goods, are being compelled by this change in consumer tastes to use more environmentally friendly materials like PLA. Companies are encouraged to investigate and invest in sustainable solutions by regulatory restrictions, such as prohibitions on single-use plastics and incentives for the use of biodegradable alternatives. Additionally, the commitment of both consumers and businesses to reducing carbon footprints aligns with PLA's renewable and compostable characteristics, driving its adoption in the marketplace. This focus on sustainability not only enhances brand reputation but also helps companies meet regulatory compliance, positioning them favourably in a competitive landscape increasingly influenced by environmental considerations.

Industry Restraint

Higher Production Cost

In contrast to traditional petroleum-based plastics, the high production costs of PLA manufacture provide a major barrier to the PLA industry. PLA is made by fermenting sugars from renewable resources, which might result in more expensive raw materials and more complicated processing needs. PLA is frequently less competitive in price-sensitive sectors as a result of this cost difference, which prevents it from being widely used in applications where cost is a crucial consideration, like mass packaging or commodity plastics. Furthermore, the scarcity of feedstocks like corn and sugarcane might make supply chain problems and price swings worse, which will impact the stability of the market as a whole. While advancements in technology and increased economies of scale are helping to mitigate these issues, the inherent cost disadvantages of PLA compared to traditional plastics continue to pose a challenge for manufacturers aiming to increase market penetration and meet the growing demand for sustainable materials.

Industry Trend

A number of noteworthy advancements are occurring in the polylactic acid (PLA) business, most notably the creation of high-performance PLA mixes and bio-based additives to improve PLA's functionality. In order to increase PLA's mechanical strength, flexibility, and resilience to heat, manufacturers are experimenting with new additives and combining it with other biodegradable materials, opening up a greater range of possibilities. For example, PLA may now more directly compete with traditional plastics thanks to the growing usage of high-performance PLA blends in demanding applications like electronics, durable consumer products, and automobile components.

Environmental pressures to limit waste have also led to an increase in recycling programs and closed-loop PLA systems. In line with the objectives of the circular economy, businesses are creating innovative recycling technologies that allow PLA goods to be decomposed and recycled. Partnerships between feedstock providers, processors, and end-product manufacturers are also becoming more popular as a way to lower costs and establish regional supply chains. When taken as a whole, these patterns show that the PLA sector is moving toward more functionality, environmental responsibility, and market flexibility.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application, Purity, End Use Industry, The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Purity

By Application

By End Use Industry

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

Frequently Asked Questions ?