Industry Overview

Aircraft jet fuel, primarily consisting of kerosene-based products such as Jet A and Jet A-1, is a critical component for the aviation industry, powering commercial, military, and private aircraft.

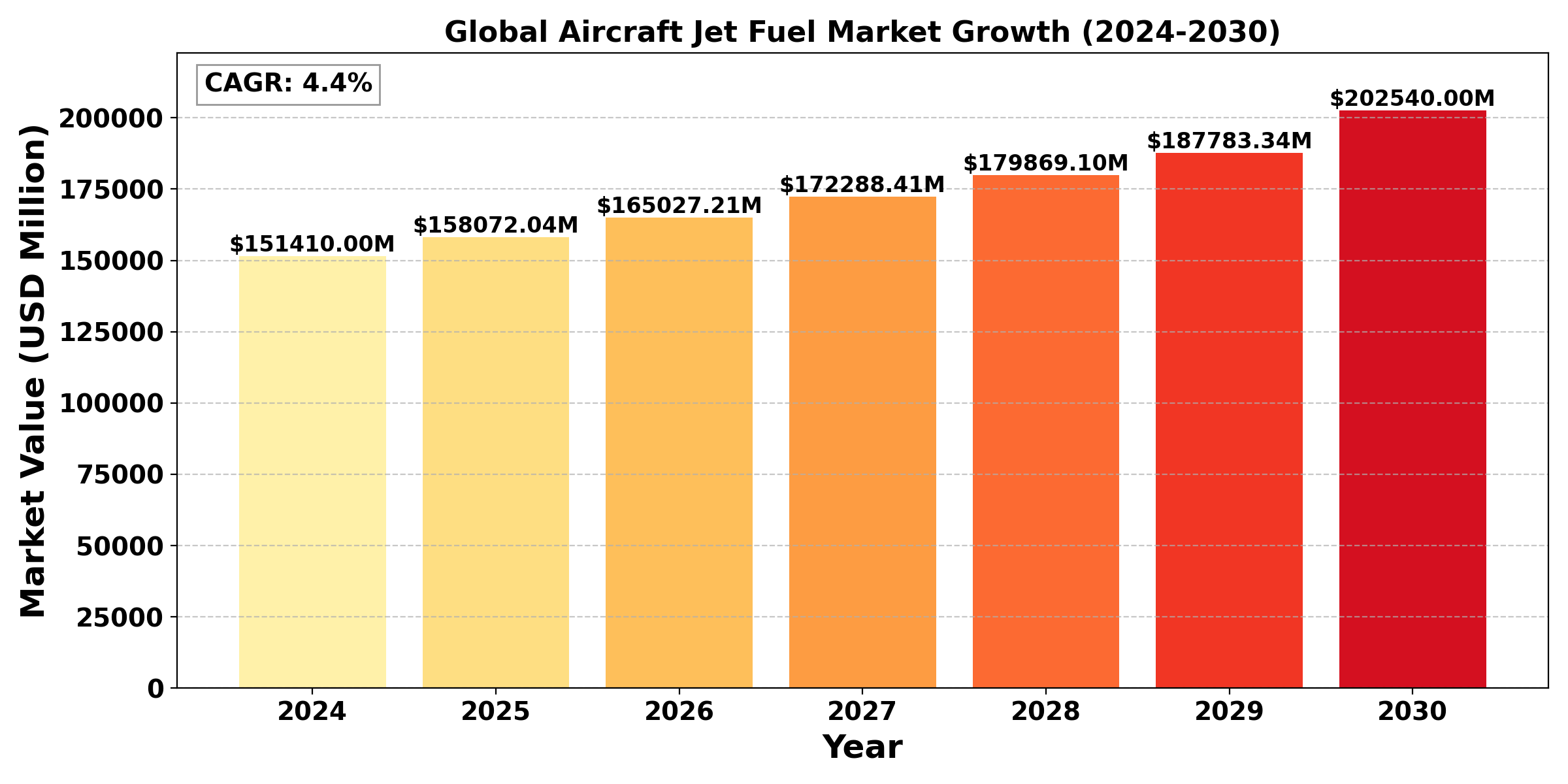

The "Global Aircraft Jet fuel Market" was valued at USD 151.41 Billion in 2024 and is projected to reach USD 202.54 Billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of 4.4% during the forecast period (2024-2030). IATA expects global jet fuel demand to reach about 99 billion gal in 2024, or roughly 6.46 million gal/day. The International Energy Agency’s 2024 forecast is a bit higher at 7.19 million gal/day.

With 7.8% of the world's oil consumption going towards fuel, the aviation sector is the one having the fastest rate of growth. Since 2009, the amount of fuel used by commercial airlines has grown annually, reaching a record-breaking 95 billion gallons in 2019. But in 2020, the pandemic led consumption to decline to 52 billion gallons; nevertheless, in 2021, it rose once again, and by 2024, it was expected to reach 99 billion gallons. However, because of increasing fuel efficiency, a decrease in freight traffic, and a decline in foreign commercial carriers, consumption grew more slowly in 2023 than it did in prior years.

According to the estimate of IATA, the airline industry consumed between 450,000 and 500,000 tons of sustainable aviation fuel (SAF) at USD 2,500 per ton (or 2.8x jet fuel) in 2023, adding an extra USD 756 million to the industry fuel bill. IATA estimates that SAF production could rise to 0.5% of airlines’ total fuel consumption in 2024, adding USD 2.4 billion to this year’s fuel bill.

Segmental Overview

Jet A-1 to hold the highest market share: By Type

Compared to Jet A, Jet A-1 has the largest market share in the aviation fuel industry. Because of its unique characteristics that meet the needs of contemporary jet engines, Jet A-1 is the recommended option for commercial aviation worldwide. It is appropriate for a larger range of temperatures and operating conditions due to its greater thermal stability, lower freeze point (-47°C), and wider boiling range, especially in international flights and a variety of climates. This feature increases Jet A-1's attractiveness to airlines by guaranteeing its deployment in the majority of commercial airplane operations.

Furthermore, Jet A-1 is recognized and approved by the International Civil Aviation Organization (ICAO), and it meets the stringent specifications set by various aviation regulatory bodies, which further reinforces its market position. The increasing number of global air travel passengers and the growth of the airline industry are driving demand for Jet A-1 fuel, particularly in regions with significant air traffic, such as North America, Europe, and Asia-Pacific.

While Jet A is used primarily in the United States and in specific regional markets, its application is limited compared to Jet A-1. As a result, Jet A-1’s broad acceptance and suitability for a wide range of aircraft make it the dominant aviation fuel type in the market, securing its significant market share.

Civil to hold the highest market share: By Application

Compared to military applications, the civil application has the largest market share in the aviation fuel market. Commercial airlines, cargo transportation, and general aviation are just a few of the many operations that fall under the broad category of civil aviation. Commercial flights and air freight operations have increased dramatically as a result of the growing demand for air travel, especially in the wake of the epidemic. This has greatly increased the consumption of aviation fuels, particularly Jet A-1.

The strong demand for civil aviation fuels is a result of the rise of low-cost airlines, the extension of air travel routes, and the increase in disposable incomes in emerging nations. Fuel consumption is expected to rise steadily as the civil aviation industry continues to grow as international travel becomes more accessible.

Regional Overview

The regional dynamics of the aviation fuel market reveal distinct trends driven by varying economic conditions, air travel demand, and regulatory environments. With a strong aviation industry and substantial domestic and international air traffic, North America—and especially the United States—is a major region. There is a strong demand for aviation fuels, particularly Jet A-1, due to the existence of large airlines and a vast airport network. Due to its wide variety of airlines and emphasis on environmental initiatives, Europe also contributes significantly to the aviation fuel market. While U.S. production reached 15.8 million gallons in 2022, it accounted for less than 0.1 percent of the total jet fuel used by major U.S. airlines.

In an effort to lower carbon emissions, European nations are investing more in alternative aviation fuels, which is influencing the market's future direction. Air travel has increased dramatically in the Asia-Pacific area due to strong economic expansion and rising disposable incomes, making it one of the aviation fuel markets with the quickest rate of growth. The expansion of aviation infrastructure in nations like China and India is a major factor in the demand for Jet A-1 fuel.

On the other hand, the Middle East continues to be an important location for international aviation, with nations like the United Arab Emirates and Qatar acting as important transit hubs. In the meanwhile, there are prospects for expansion in the aviation fuel industry due to the growing demand for air travel in emerging regions like Latin America and Africa. All things considered, the regional overview highlights a market that is dynamic and changing due to a number of variables, such as environmental initiatives and economic development.

Competitive Analysis

The aircraft jet fuel industry has the presence of large number of national as well as international players. Most of the company operating in this industry has been working continuously and investing heavily in the research and developmental activities, in order to develop sustainable options. Moreover the presence of various regulations and standards has also contributed for the industry growth for instance, the European regulation announced that 2% of jet fuel must be sustainable as of 2025, and 70% by 2050. Companies has also been working towards collaboration and mergers and acquisition in order to expand its reach some of the key players in the aircraft jet fuel industry includes Air BP, Chevron, Exide, Exxon Mobil, Gazprom, Shell, AltAir Fuels, Amyris, Gevo, Hindustan petroleum, Honeywell, LanzaTech, Neste Oil, Primus Green Energy,SkyNRG, Solazyme, Solena Fuels, Equinor etc.

Recent Development

➣ In June 2022, AEG Fuels, a Florida-based company, has introduced a platform for sustainable aviation fuel (SAF), claiming to give operators of commercial and private aircraft a one-stop shop to obtain SAF at over 20 locations across the globe.

➣ In April 2023, Indian Oil Corporation plans to establish a joint venture to create sustainable aviation fuel (SAF) with multiple domestic airlines and the US-based renewable energy technology company LanzaJet Inc. The proposed firm, valued at USD 366 million, would create a factory at the state-run company's Panipat refinery in Haryana to make SAF utilising alcohol-to-jet technology.

End Use Industry Analysis

In terms of end-use the aircraft jet fuel industry has been segmented as Commercial Aviation, Military Aviation, and Private and Business Aviation. The Market for aircraft jet fuel is dominated by commercial aviation. This includes passenger airlines, cargo carriers, and regional airlines. The growth of global air travel and the expansion of airline networks significantly drive jet fuel demand. According to the EIA estimate commercial aviation typically accounts for around 85% of jet fuel consumed in the United States. General aviation accounts for around 8% of jet fuel consumption, and U.S. military and U.S. government consumers account for around 7% of jet fuel consumption. Of the three, the amount of fuel used by commercial jets was most impacted by the travel restrictions during the pandemic, declining by 42% between 2019 and 2020. Commercial aircraft used 8% less fuel in 2023 than they did in 2019. Only 11% less fuel was used by general aviation users in 2020 compared to 2019. Travel limitations had considerably less of an impact on military and government users; between 2019 and 2020, their jet fuel use decreased by just 7%. By 2021, the amount of jet fuel used in general aviation, government, and military aircraft had returned to pre-pandemic levels.

Industry Dynamics

Industry Driver

Rapid growth in global Air Travel Demand

The demand for air travel is growing rapidly worldwide, which is one of the main factors driving the aviation fuel market. A considerable surge in passenger traffic results from more people being able to afford air travel as economies grow and disposable incomes rise. This increase in demand is especially noticeable in developing Asia-Pacific and African economies, where growing middle classes are making leisure and business travel a top priority. A wider range of people may now afford to travel by air thanks to the emergence of low-cost airlines. Furthermore, the continued recovery from the COVID-19 epidemic has led to a rise in both domestic and international travel, which has increased aircraft fuel usage. Airlines are also expanding their fleets and optimizing their routes to accommodate this growing demand, further propelling the need for jet fuel. As global connectivity continues to strengthen and travel trends evolve, the aviation fuel industry is positioned for sustained growth, driven by this increasing demand for air travel across various regions and demographics.

The revenue passenger kilometres, or RPKs, representing total traffic in 2023 increased by 36.9% over 2022. Traffic for the entire year 2023 was 94.1% of levels observed prior to the outbreak in 2019. The overall traffic in December 2023 increased by 25.3% over December 2022, reaching 97.5% of the amount recorded in December 2019. The robust recovery towards the end of the year was reflected in the fourth quarter traffic, which was at 98.2% of 2019.

2023 had a 41.6% increase in international traffic over 2022, reaching 88.6% of 2019 levels. International traffic reached 94.7% of its December 2019 level in December 2023, up 24.2% from December 2022.

In 2023, domestic traffic increased by 30.4% over the previous year. Domestic traffic in 2023 increased 3.9% over the same period in 2019. Domestic traffic in December 2023 increased by 27.0% from the same month the previous year and by 2.3% from December 2019. Compared to the same period in 2019, traffic increased by 4.4% in the fourth quarter.

Industry Restraint

Volatility of Crude Oil Prices

The volatility of crude oil prices, which has a major impact on fuel production and pricing, is one of the main constraints on the aviation fuel sector. Because aviation fuel is made from crude oil, changes in the world's oil markets may cause airlines and fuel providers to incur unforeseen expenses. Natural disasters, OPEC production policy changes, and geopolitical conflicts can all intensify this volatility, causing uncertainty that impacts airline budgeting and long-term planning. In addition to hurting airline profits, high fuel prices can raise ticket costs, which might put off travellers and lower demand for air travel.

Furthermore, a major obstacle facing the aviation fuel sector is the growing environmental concerns and regulatory demands associated with greenhouse gas emissions. Globally, governments are enforcing more stringent emissions laws and advocating for sustainable aviation fuels (SAFs) as substitutes for conventional jet fuel. Although switching to SAFs is essential for lowering the carbon footprint of the aviation sector, the industry's ability to grow and adjust to regulatory changes may be hampered by the fuels' limited manufacturing capacity and availability. Together, these elements produce a complicated environment for the aviation fuel sector that limits its potential and forces a necessary shift to more environmentally friendly methods.

Industry Trend

The aviation fuel sector is progressively emphasizing sustainability and innovation in response to growing environmental concerns and regulatory constraints. With significant expenditures from airlines and fuel manufacturers as well as government incentives, the use of Sustainable Aviation Fuel (SAF) made from renewable resources is growing. Reducing reliance on traditional jet fuel is being made possible by technological developments in electric and hybrid aircraft as well as increases in fuel efficiency. As possible substitutes, the industry is also looking at hydrogen and synthetic fuels. Stricter emission regulations and carbon offsetting initiatives are also encouraging airlines to use more environmentally friendly procedures.

Report Scope

The report includes Global & Regional market status and outlook for 2017-2028. Further, the report provides breakdown details about each region & countries covered in the report. Identifying its sales, sales volume & revenue forecast. With detailed analysis by Type, Application. The report also covers the key players of the industry including Company Profile, Product Specifications, Production Capacity/Sales, Revenue, Price, and Gross Margin 2017-2028 & Sales with a thorough analysis of the market’s competitive landscape and detailed information on vendors and comprehensive details of factors that will challenge the growth of major market vendors.

|

Attributes |

Details |

|

Segments |

By Type

By Application

|

|

Region Covered |

|

|

Key Market Players |

|

|

Report Coverage |

|

Frequently Asked Questions ?