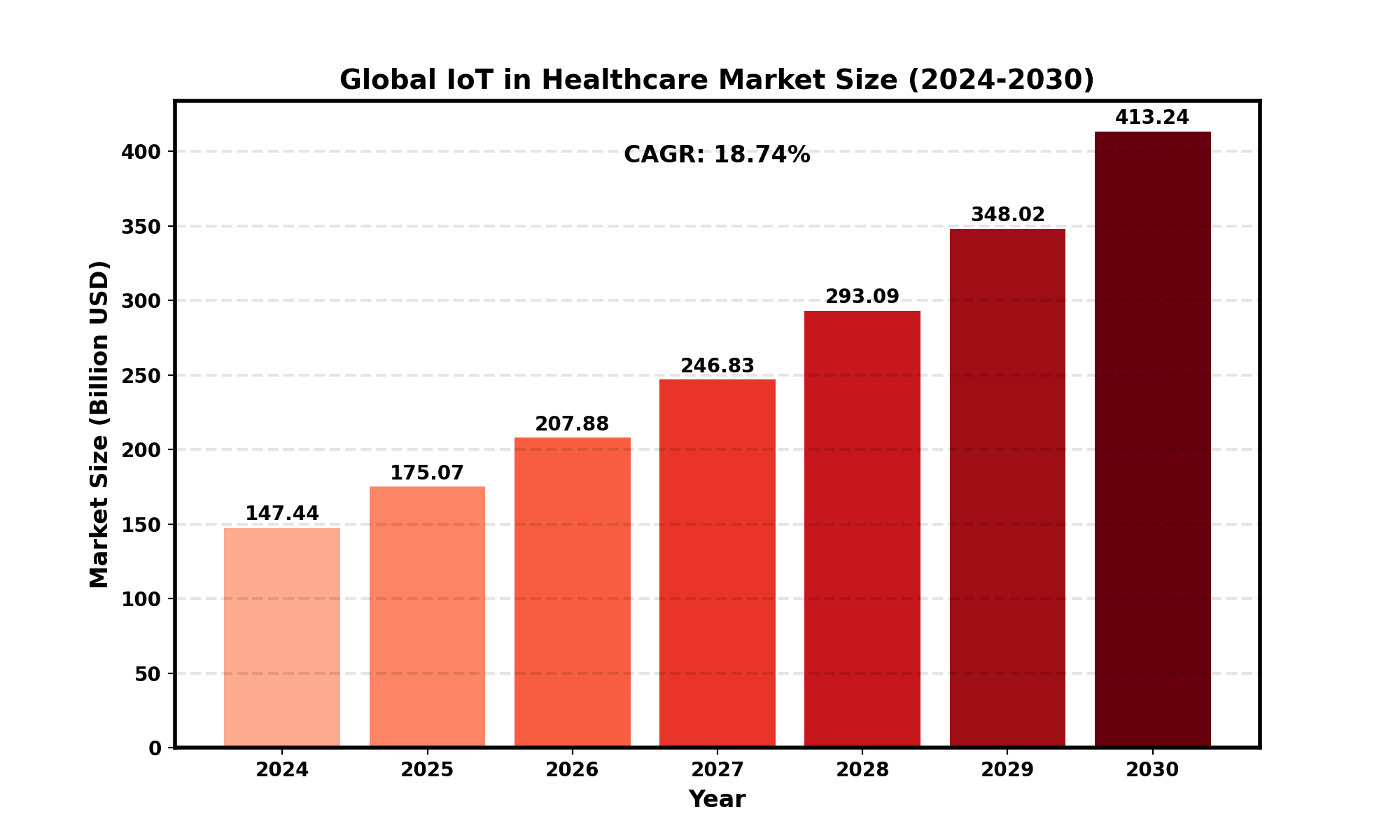

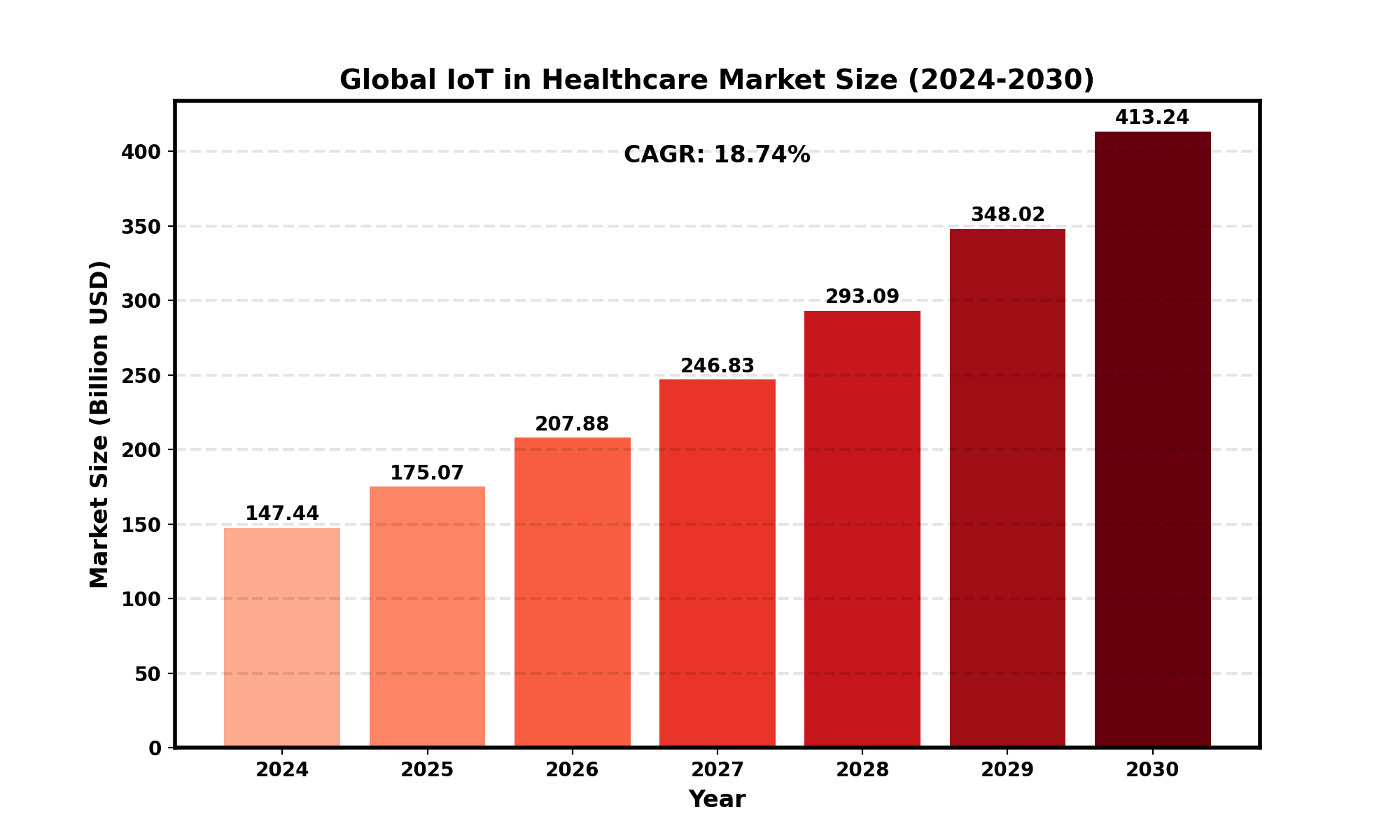

IoT in Healthcare Market, Global Outlook and Forecast 2024-2030

The global IoT in Healthcare market was valued at US$ 147.44 billion in 2024 and is projected to reach US$ 413.24 billion by 2030, at a CAGR of 18.74% during the forecast period.

The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

The global key manufacturers of IoT in Healthcare include Apple, Cisco Systems, GE Healthcare, Google, International Business Machines Corporation, Medtronic PLC, Microsoft Corporation, Proteus Digital Health and Koninklijke Philips, etc. in 2024, the global top five players have a share approximately % in terms of revenue.

This report aims to provide a comprehensive presentation of the global market for IoT in Healthcare, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding IoT in Healthcare. This report contains market size and forecasts of IoT in Healthcare in global, including the following market information:

- Global IoT in Healthcare Market Revenue, 2019-2024, 2025-2030, ($ millions)

- Global top five companies in 2024 (%)

The Internet of Things (IoT) is transforming the healthcare industry by connecting devices, systems, and people to improve patient outcomes, enhance operational efficiency, and reduce costs.

Remote Patient Monitoring (RPM):

- RPM solutions, which utilize IoT devices to collect and transmit patient data, are predicted to save the U.S. healthcare system approximately $6 billion annually by reducing hospital readmissions and improving chronic disease management.

- By 2025, it is estimated that 70.6 million patients in the U.S. will use RPM tools, up from 28.9 million in 2020. This rapid adoption underscores the growing reliance on IoT technology for continuous health monitoring.

Wearable Devices:

- The global market for wearable healthcare devices is projected to reach $60 billion by 2025, driven by the popularity of fitness trackers, smartwatches, and wearable ECG monitors. These devices help individuals monitor their health in real-time, providing valuable data to healthcare providers.

- Over 80% of consumers are willing to wear fitness technology, reflecting a significant shift towards proactive health management and the increasing trust in IoT-enabled devices.

Telehealth Services:

- The COVID-19 pandemic accelerated the adoption of telehealth services, which heavily rely on IoT technology. In 2020, telehealth usage increased by 154% compared to 2019.

- Approximately 75% of hospitals in the U.S. are now connected to telehealth services, leveraging IoT to provide remote consultations, diagnostics, and treatment, thereby enhancing access to healthcare.

Operational Efficiency:

- IoT solutions in healthcare are estimated to reduce operational costs by 25-30% by streamlining processes such as asset management, inventory control, and predictive maintenance of medical equipment.

- Smart hospital systems, enabled by IoT, can optimize energy usage, enhance security, and improve patient flow, contributing to overall efficiency and patient satisfaction.

Patient Outcomes:

- IoT-enabled healthcare systems can improve patient outcomes by 20-30% through early detection of health issues, personalized treatment plans, and continuous health monitoring.

- Hospitals using IoT technology report a 50% reduction in emergency room wait times and a 30% decrease in hospital stay duration, resulting in better patient experiences and outcomes.

Chronic Disease Management:

- IoT devices play a crucial role in managing chronic diseases such as diabetes, heart disease, and COPD. For instance, smart insulin pens, glucose monitors, and connected inhalers provide real-time data, helping patients manage their conditions more effectively.

- By 2024, it is expected that IoT-based chronic disease management solutions will save $1.1 trillion in healthcare costs globally.

The integration of IoT in healthcare is reshaping the industry, providing innovative solutions to long-standing challenges, and setting the stage for a more connected, efficient, and patient-centric healthcare system.

We surveyed the IoT in Healthcare companies, and industry experts on this industry, involving the revenue, demand, product type, recent developments and plans, industry trends, drivers, challenges, obstacles, and potential risks.

Total Market by Segment:

Global IoT in Healthcare Market, by Type, 2019-2024, 2025-2030 ($ millions)

Global IoT in Healthcare Market Segment Percentages, by Type, 2024 (%)

- Bluetooth-based

- Wi-Fi-based

- NFC-based

- Zigbee-based

Global IoT in Healthcare Market, by Application, 2019-2024, 2025-2030 ($ millions)

Global IoT in Healthcare Market Segment Percentages, by Application, 2024 (%)

- Hospital

- Pharmaceutical

- Clinic

- Laboratory

- Others

Global IoT in Healthcare Market, By Region and Country, 2019-2024, 2025-2030 ($ Millions)

Global IoT in Healthcare Market Segment Percentages, By Region and Country, 2024 (%)

- North America (United States, Canada, Mexico)

- Europe (Germany, France, United Kingdom, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, India, Japan, South Korea, Australia, Rest of APAC)

- The Middle East and Africa (Middle East, Africa)

- South and Central America (Brazil, Argentina, Rest of SCA)

Competitor Analysis

The report also provides analysis of leading market participants including:

- Key companies IoT in Healthcare revenues in global market, 2019-2024 (estimated), ($ millions)

- Key companies IoT in Healthcare revenues share in global market, 2024 (%)

key players include:

- Apple

- Cisco Systems

- GE Healthcare

- Google

- International Business Machines Corporation

- Medtronic PLC

- Microsoft Corporation

- Proteus Digital Health

- Koninklijke Philips

- QUALCOMM Incorporated

- Abbot Laboratories

- Including or Excluding key companies relevant to your analysis.

Outline of Major Chapters:

Chapter 1: Introduces the definition of IoT in Healthcare, market overview.

Chapter 2: Global IoT in Healthcare market size in revenue.

Chapter 3: Detailed analysis of IoT in Healthcare company competitive landscape, revenue and market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides the analysis of various market segments by type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 5: Provides the analysis of various market segments by application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 6: Sales of IoT in Healthcare in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space of each country in the world.

Chapter 7: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 8: The main points and conclusions of the report.