TOP CATEGORY: Chemicals & Materials | Life Sciences | Banking & Finance | ICT Media

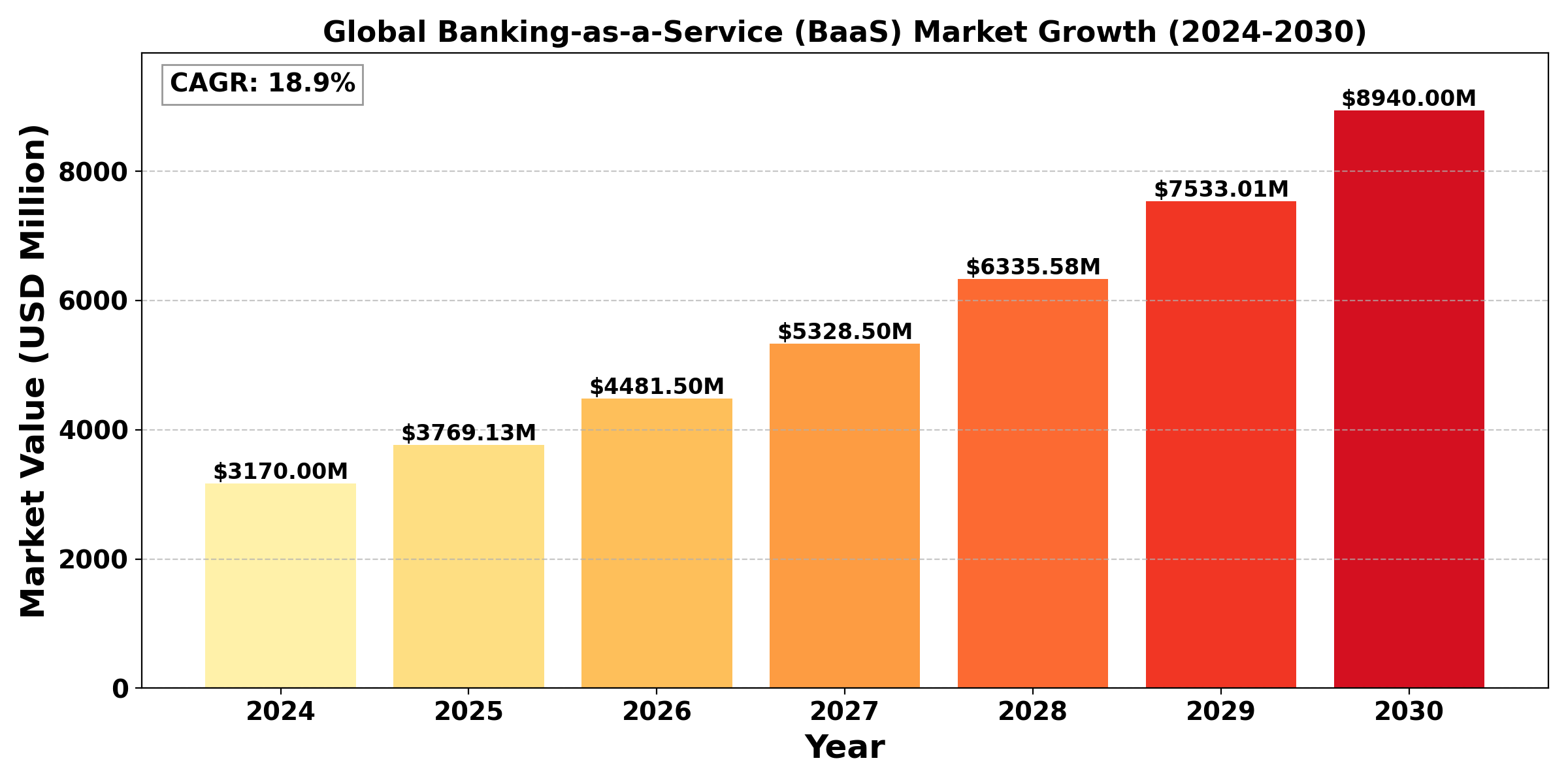

The "Global Banking-as-a-Service (BaaS) Market size was valued at US$ 3.17 billion in 2024 and is projected to reach US$ 8.94 billion by 2030, at a CAGR of 18.9% during the forecast period 2024-2030.

The "United States Banking-as-a-Service (BaaS) Market" size was valued at US$ 982.7 million in 2024 and is projected to reach US$ 2.71 billion by 2030, at a CAGR of 18.4% during the forecast period 2024-2030.

Banking-as-a-Service (BaaS) refers to a financial technology model where licensed banks provide their infrastructure, APIs, and regulatory compliance to third-party businesses, enabling them to offer financial services like payments, loans, or card issuance under their own branding.

Banking-as-a-Service (BaaS) is a model where licensed banks integrate their digital banking services directly into the products of non-bank businesses, enabling these businesses to offer financial services without becoming a bank themselves.

The Banking-as-a-Service market is experiencing rapid growth, driven by the increasing digitalization of financial services and the rise of fintech companies. The market benefits from growing consumer demand for seamless and integrated financial experiences. There's rising adoption by traditional banks as a way to expand their reach and collaborate with innovative startups. The market is seeing innovation in API-based platforms that enable easy integration of banking services. Challenges include ensuring regulatory compliance across different jurisdictions and managing data security risks. The ongoing trend towards open banking and the growing embedded finance ecosystem are expected to drive continued strong market growth.

Report Overview

Bankingas aservice(BaaS) is an end-to-end process ensuring the overall execution of a financialserviceprovided over the web. Such a digitalbanking serviceis available on demand and is carried out within a set time-frame.

Banking-as-a-Service Market provides a deep insight into the global Banking-as-a-Service (BaaS) market covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and accessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Banking-as-a-Service (BaaS) Market, Banking-as-a-Service Market introduces in detail the market share, market performance, product situation, operation situation, etc. of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, Banking-as-a-Service Market is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Banking-as-a-Service (BaaS) market in any manner.

Global Banking-as-a-Service (BaaS) Market: Market Segmentation Analysis

The research report includes specific segments by region (country), manufacturers, Type, and Application. Market segmentation creates subsets of a market based on product type, end-user or application, Geographic, and other factors. By understanding the market segments, the decision-maker can leverage this targeting in the product, sales, and marketing strategies. Market segments can power your product development cycles by informing how you create product offerings for different segments.

Key Company

By Type

By Application

Geographic Segmentation

Key Benefits of This Market Research:

Key Reasons to Buy this Report: