The United States Next Generation Automotive Sensor market encompasses the development, manufacturing, and utilization of advanced sensors in vehicles. These sensors are integral to enhancing safety, performance, and driving capabilities, especially with the rise of autonomous and electric vehicles. The key components of the market include image sensors, radar sensors, and other types of sensors that contribute to advanced driver-assistance systems (ADAS), autonomous driving, and connected vehicle technologies. These sensors collect data to monitor the vehicle’s surroundings, providing real-time information that aids in decision-making and improves the overall driving experience.

Next-generation automotive sensors are fundamental to the development of modern vehicles, offering a higher degree of intelligence, safety, and automation. Their applications range from power systems to body comfort systems, with a growing demand for innovations in sensor fusion and artificial intelligence (AI) to drive vehicle intelligence forward.

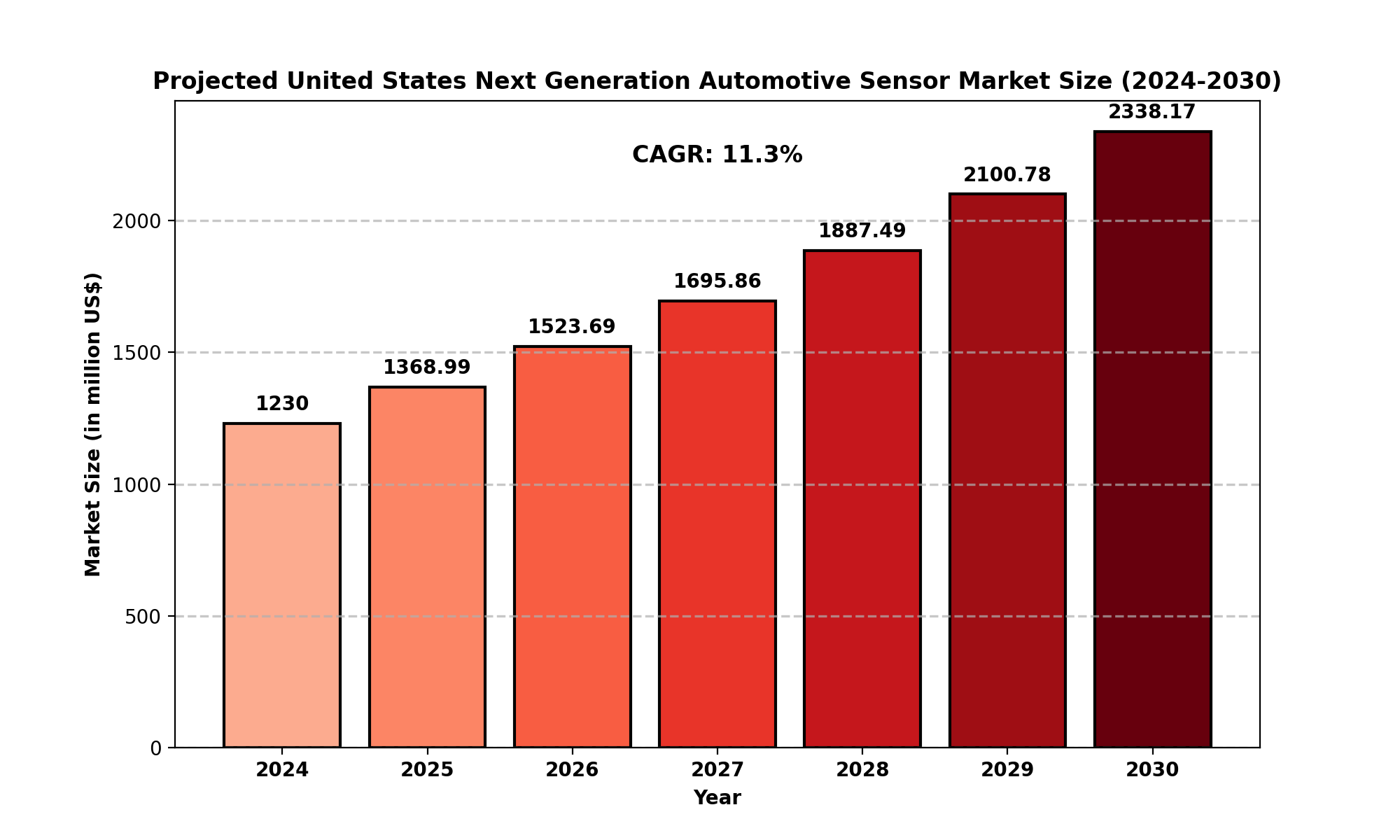

The United States Next Generation Automotive Sensor market is poised for significant growth. In 2024, the market was valued at US$ 1.23 billion, with projections indicating it will reach US$ 2.33 billion by 2030, expanding at a robust CAGR of 11.3% during the forecast period from 2024 to 2030.

This growth trajectory is driven by several factors, including the increasing adoption of ADAS, the growing market for autonomous vehicles, and the rise in demand for connected and electric vehicles. As automotive manufacturers continue to prioritize safety, performance, and intelligence in vehicle systems, the demand for next-generation sensors will continue to surge.

Adoption of ADAS and Autonomous Driving Technologies: As the automotive industry pushes for more advanced driver-assistance features, the demand for sensors like cameras, radars, and LiDAR has risen. These sensors are critical for enabling features such as lane-keeping assistance, adaptive cruise control, and autonomous driving capabilities.

Demand for Electric Vehicles (EVs): Electric vehicles are becoming a significant part of the global automotive ecosystem. These vehicles rely heavily on sensors for functions such as battery management, energy efficiency, and enhanced safety features.

Sensor Fusion and Artificial Intelligence: Advancements in sensor fusion technology, combined with AI, allow for more precise and reliable vehicle intelligence. This integration enables the seamless operation of autonomous and semi-autonomous vehicles, creating a higher demand for sensors.

Stringent Safety Regulations: Growing regulatory pressure for enhanced vehicle safety systems, especially in terms of crash prevention and driver assistance, is accelerating the use of advanced sensors in vehicles.

High Cost of Advanced Sensors: The production and integration of advanced sensors, particularly LiDAR and radar systems, can be costly, which may hinder their widespread adoption in more budget-friendly vehicles.

Technological Challenges: While sensors are becoming more advanced, challenges related to sensor calibration, integration, and reliability in various environmental conditions still exist. Overcoming these challenges is essential for widespread deployment.

Data Privacy Concerns: The use of connected vehicle technology, driven by these sensors, raises concerns about data security and privacy. Ensuring that vehicle data is kept secure is a major challenge.

Growth in Autonomous Vehicle Technology: As autonomous vehicle technology progresses, the demand for sophisticated sensors will only increase. Companies that can innovate in the realm of sensor technology are positioned for significant growth.

Smart Infrastructure and Connected Vehicles: With the rise of smart cities and connected infrastructure, vehicles with advanced sensor systems can communicate with roadways and traffic management systems, creating opportunities for manufacturers to provide sensors for these interconnected systems.

Market Fragmentation: The market for next-generation automotive sensors is fragmented, with many players offering a range of sensor solutions. Manufacturers need to navigate competition and find unique selling points to differentiate their offerings.

Integration with Existing Vehicle Platforms: Integrating next-generation sensors into legacy vehicle models and infrastructure presents a challenge, as older systems may not support newer sensor technologies.

The United States is expected to remain the largest market for next-generation automotive sensors, driven by the country's leadership in automotive technology innovation. Key regions within the U.S. will experience varied demand:

California: As a hub for electric and autonomous vehicle manufacturing, California is likely to see the highest demand for advanced automotive sensors, especially with major companies like Tesla, Waymo, and others pushing the boundaries of autonomous driving technology.

Michigan: As the heart of the U.S. automotive industry, Michigan will continue to be a major player in the development and deployment of next-generation automotive sensors, especially for traditional automakers upgrading to more advanced technologies.

Texas: With its growing automotive sector, particularly in the electric vehicle market, Texas will witness an increase in the demand for sensors, especially related to battery management and vehicle performance monitoring.

The competitive landscape of the United States Next Generation Automotive Sensor market is marked by the presence of several leading companies. These key players dominate the market and drive innovations in sensor technologies:

Texas Instruments: A significant player in the sensor market, offering a range of sensors for ADAS and autonomous vehicles.

Analog Devices, Inc.: Known for its cutting-edge sensor solutions, Analog Devices continues to innovate in automotive sensors for enhanced vehicle safety and performance.

TE Connectivity: A leader in providing sensors for a variety of automotive applications, including power systems and body safety systems.

Sensata Technologies: Offers a wide range of sensor technologies for automotive applications, focusing on efficiency and safety improvements.

Velodyne Lidar, Inc.: A leader in LiDAR technology, Velodyne plays a critical role in enabling autonomous vehicle technology.

These companies, along with others like Aptiv, Autoliv, and Allegro Microsystems, are at the forefront of technological advancements, positioning themselves as key players in the market.

This report provides a deep insight into the global Next Generation Automotive Sensor market, covering all its essential aspects. This ranges from a macro overview of the market to micro details of the market size, competitive landscape, development trend, niche market, key market drivers and challenges, SWOT analysis, value chain analysis, etc.

The analysis helps the reader to shape the competition within the industries and strategies for the competitive environment to enhance the potential profit. Furthermore, it provides a simple framework for evaluating and assessing the position of the business organization. The report structure also focuses on the competitive landscape of the Global Next Generation Automotive Sensor. This report introduces in detail the market share, market performance, product situation, operation situation, etc., of the main players, which helps the readers in the industry to identify the main competitors and deeply understand the competition pattern of the market.

In a word, this report is a must-read for industry players, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Next Generation Automotive Sensor market in any manner.

What is the current market size of the United States Next Generation Automotive Sensor market?

Which are the key companies operating in the Next Generation Automotive Sensor market?

What are the key growth drivers in the Next Generation Automotive Sensor market?

Which regions dominate the Next Generation Automotive Sensor market?

What are the emerging trends in the Next Generation Automotive Sensor market?

Key Indicators Analysed

Key Benefits of This Market Research:

Key Reasons to Buy this Report:

We offer additional regional and global reports that are similar:

Customization of the Report: In case of any queries or customization requirements, please connect with our sales team, who will ensure that your requirements are meet.

1.1 Next Generation Automotive Sensor Product Introduction

1.2.1 United Statesn Next Generation Automotive Sensor Market Size Growth Rate by Type, 2019 VS 2023 VS 2030

1.2.2 Image Sensor

1.2.3 Radar Sensor

1.2.4 Other

1.3.1 United States Next Generation Automotive Sensor Market Size Growth Rate by Application, 2019 VS 2023 VS 2030

1.3.2 Power System

1.3.3 Transmission System

1.3.4 Chassis and Body Safety System

1.3.5 Body Comfort System

1.4 United States Next Generation Automotive Sensor Sales Estimates and Forecasts 2019-2030

1.5 United States Next Generation Automotive Sensor Hydrocephalus Shunts Revenue Estimates and Forecasts 2019-2030

1.6 Study Objectives

1.7 Years Considered

2.1 United States Next Generation Automotive Sensor Sales by Manufacturers

2.1.1 United States Next Generation Automotive Sensor Sales by Manufacturers (2019-2024)

2.1.2 United States Next Generation Automotive Sensor Sales Market Share by Manufacturers (2019-2024)

2.1.3 Top Largest Manufacturers of Next Generation Automotive Sensor in 2023 in United States

2.2 United States Next Generation Automotive Sensor Revenue by Manufacturers

2.2.1 United States Next Generation Automotive Sensor Revenue by Manufacturers (2019-2024)

2.2.2 United States Next Generation Automotive Sensor Revenue Market Share by Manufacturers (2019-2024)

2.2.3 United States Top Companies by Next Generation Automotive Sensor Revenue in 2023

2.3 United States Next Generation Automotive Sensor Sales Price by Manufacturers (2019-2024)

2.4 Analysis of Competitive Landscape

2.4.1 Manufacturers Market Concentration Ratio (CR3 and HHI)

2.4.2 United States Next Generation Automotive Sensor by Company Type (Tier 1, Tier 2, and Tier 3)

2.4.3 United States Next Generation Automotive Sensor Manufacturers Geographical Distribution

2.5 Mergers & Acquisitions, Expansion Plans

3.1 Next Generation Automotive Sensor Market Size by Region: 2019-2030

3.1.1 United States Next Generation Automotive Sensor Sales by Region: 2019-2024

3.1.2 United States Next Generation Automotive Sensor Sales Forecast by Region (2025-2030)

3.1.3 United States Next Generation Automotive Sensor Revenue by Region: 2019-2024

3.1.4 United States Next Generation Automotive Sensor Revenue Forecast by Region (2025-2030)

4.1 United States Next Generation Automotive Sensor Sales by Type

4.1.1 United States Next Generation Automotive Sensor Historical Sales by Type (2019-2024)

4.1.2 United States Next Generation Automotive Sensor Forecasted Sales by Type (2025-2030)

4.1.3 United States Next Generation Automotive Sensor Sales Market Share by Type (2019-2030)

4.2 United States Next Generation Automotive Sensor Revenue by Type

4.2.1 United States Next Generation Automotive Sensor Historical Revenue by Type (2019-2024)

4.2.2 United States Next Generation Automotive Sensor Forecasted Revenue by Type (2025-2030)

4.2.3 United States Next Generation Automotive Sensor Revenue Market Share by Type (2019-2030)

4.3 United States Next Generation Automotive Sensor Price by Type

4.3.1 United States Next Generation Automotive Sensor Price by Type (2019-2024)

4.3.2 United States Next Generation Automotive Sensor Price Forecast by Type (2025-2030)

5.1 United States Next Generation Automotive Sensor Sales by Application

5.1.1 United States Next Generation Automotive Sensor Historical Sales by Application (2019-2024)

5.1.2 United States Next Generation Automotive Sensor Forecasted Sales by Application (2025-2030)

5.1.3 United States Next Generation Automotive Sensor Sales Market Share by Application (2019-2030)

5.2 United States Next Generation Automotive Sensor Revenue by Application

5.2.1 United States Next Generation Automotive Sensor Historical Revenue by Application (2019-2024)

5.2.2 United States Next Generation Automotive Sensor Forecasted Revenue by Application (2025-2030)

5.2.3 United States Next Generation Automotive Sensor Revenue Market Share by Application (2019-2030)

5.3 United States Next Generation Automotive Sensor Price by Application

5.3.1 United States Next Generation Automotive Sensor Price by Application (2019-2024)

5.3.2 United States Next Generation Automotive Sensor Price Forecast by Application (2025-2030)

6.1 Texas Instruments

6.1.1 Texas Instruments Corporation Information

6.1.2 Texas Instruments Overview

6.1.3 Texas Instruments in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.1.4 Texas Instruments Next Generation Automotive Sensor Product Introduction

6.1.5 Texas Instruments Recent Developments

6.2 Analog Devices, Inc.

6.2.1 Analog Devices, Inc. Corporation Information

6.2.2 Analog Devices, Inc. Overview

6.2.3 Analog Devices, Inc. in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.2.4 Analog Devices, Inc. Next Generation Automotive Sensor Product Introduction

6.2.5 Analog Devices, Inc. Recent Developments

6.3 TE Connectivity

6.3.1 TE Connectivity Corporation Information

6.3.2 TE Connectivity Overview

6.3.3 TE Connectivity in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.3.4 TE Connectivity Next Generation Automotive Sensor Product Introduction

6.3.5 TE Connectivity Recent Developments

6.4 Sensata Technologies

6.4.1 Sensata Technologies Corporation Information

6.4.2 Sensata Technologies Overview

6.4.3 Sensata Technologies in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.4.4 Sensata Technologies Next Generation Automotive Sensor Product Introduction

6.4.5 Sensata Technologies Recent Developments

6.5 Allegro Microsystems, LLC

6.5.1 Allegro Microsystems, LLC Corporation Information

6.5.2 Allegro Microsystems, LLC Overview

6.5.3 Allegro Microsystems, LLC in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.5.4 Allegro Microsystems, LLC Next Generation Automotive Sensor Product Introduction

6.5.5 Allegro Microsystems, LLC Recent Developments

6.6 Littelfuse, Inc.

6.6.1 Littelfuse, Inc. Corporation Information

6.6.2 Littelfuse, Inc. Overview

6.6.3 Littelfuse, Inc. in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.6.4 Littelfuse, Inc. Next Generation Automotive Sensor Product Introduction

6.6.5 Littelfuse, Inc. Recent Developments

6.7 Quanergy Systems, Inc.

6.7.1 Quanergy Systems, Inc. Corporation Information

6.7.2 Quanergy Systems, Inc. Overview

6.7.3 Quanergy Systems, Inc. in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.7.4 Quanergy Systems, Inc. Next Generation Automotive Sensor Product Introduction

6.7.5 Quanergy Systems, Inc. Recent Developments

6.8 Velodyne Lidar, Inc.

6.8.1 Velodyne Lidar, Inc. Corporation Information

6.8.2 Velodyne Lidar, Inc. Overview

6.8.3 Velodyne Lidar, Inc. in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.8.4 Velodyne Lidar, Inc. Next Generation Automotive Sensor Product Introduction

6.8.5 Velodyne Lidar, Inc. Recent Developments

6.9 Aptiv

6.9.1 Aptiv Corporation Information

6.9.2 Aptiv Overview

6.9.3 Aptiv in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.9.4Aptiv Next Generation Automotive Sensor Product Introduction

6.9.5 Aptiv Recent Developments

6.10 Autoliv Inc.

6.10.1 Autoliv Inc. Corporation Information

6.10.2 Autoliv Inc. Overview

6.10.3 Autoliv Inc. in United States: Next Generation Automotive Sensor Sales, Price, Revenue and Gross Margin (2019-2024)

6.10.4 Autoliv Inc. Next Generation Automotive Sensor Product Introduction

6.10.5 Autoliv Inc. Recent Developments

7.1 Next Generation Automotive Sensor Industry Chain Analysis

7.2 Next Generation Automotive Sensor Key Raw Materials

7.2.1 Key Raw Materials

7.2.2 Raw Materials Key Suppliers

7.3 Next Generation Automotive Sensor Production Mode & Process

7.4 Next Generation Automotive Sensor Sales and Marketing

7.4.1 Next Generation Automotive Sensor Sales Channels

7.4.2 Next Generation Automotive Sensor Distributors

7.5 Next Generation Automotive Sensor Customers

8.1.1 Next Generation Automotive Sensor Industry Trends

8.1.2 Next Generation Automotive Sensor Market Drivers

8.1.3 Next Generation Automotive Sensor Market Challenges

8.1.4 Next Generation Automotive Sensor Market Restraints

10.1 Research Methodology

10.1.1 Methodology/Research Approach

10.1.2 Data Source

10.2 Author Details

10.3 Disclaimer

Frequently Asked Questions ?